What we do

Buying a business? We help you establish winning strategy, identify risks, and maximize value.

Applying the same strategy & valuation frameworks, tools, and methodology used by Fortune 500 companies, we answer:

How big is the market?

What is the competitive landscape?

What strategy best fits the opportunity?

What is the value-creation potential?

What is it worth?

What are the risks?

What you get

Scheduled Consultation & Review Time

Presentation-ready Slide Content

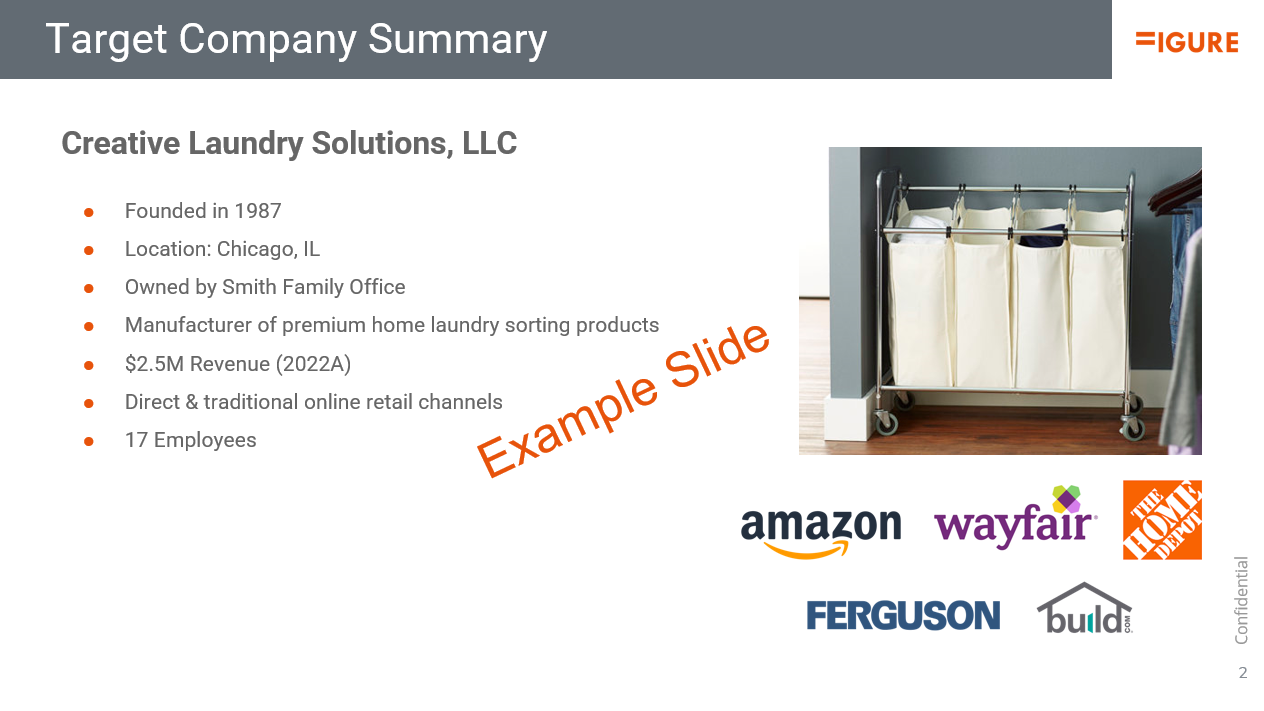

Company & Organization Summaries

Product / Services Summary

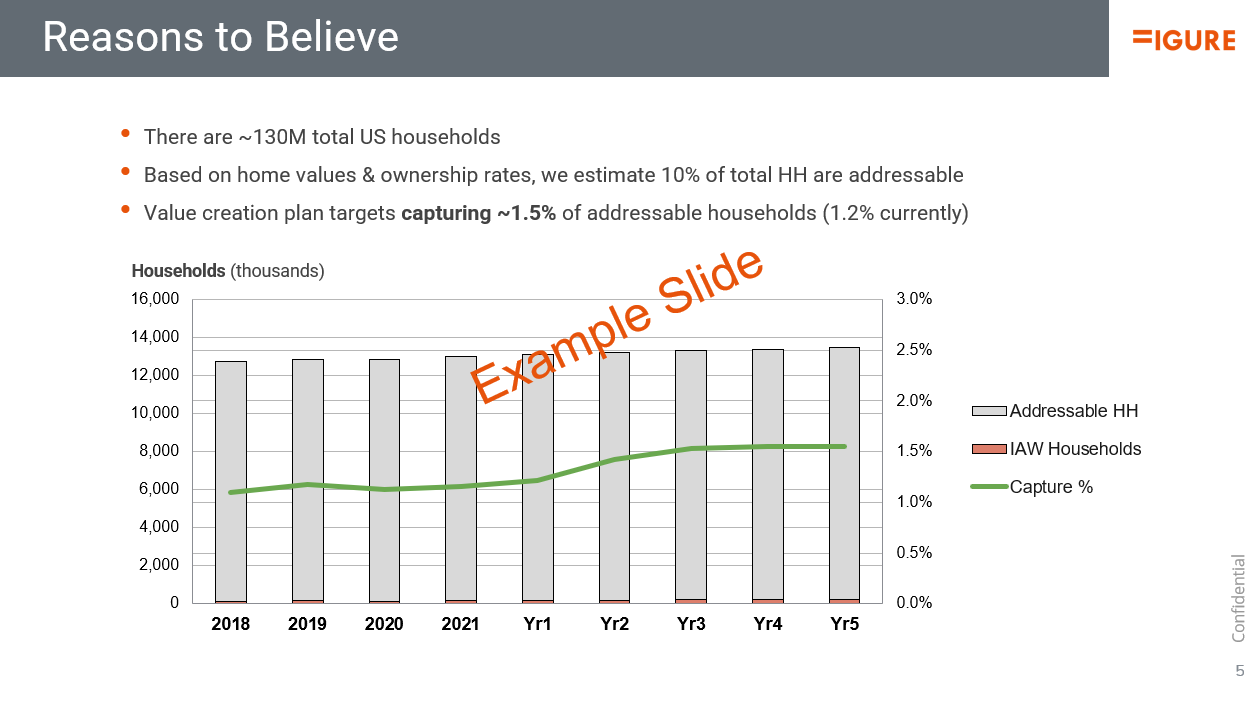

Estimated Addressable Market

Competitive Landscape

Strategy / Value Creation Opportunities

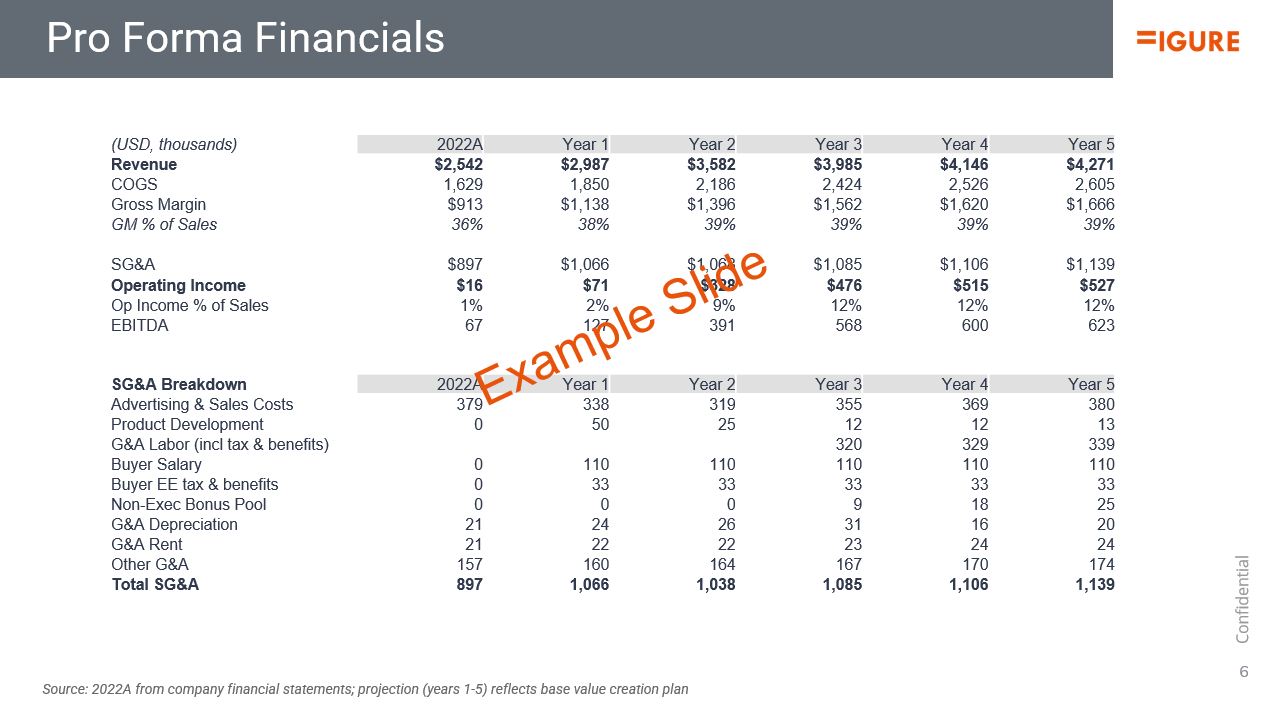

Pro-forma Financials & ROIC profile

Valuation Summary & Assumptions

Due Diligence & Structuring Pointers

Research Files & References

Our process & pricing

Straightforward Process

1 Initial Consultation

2 Engagement Letter

3 Research & Analysis

4 Valuation & Strategy

5 Calibration & Feedback

6 Final Project Delivery

Transparent Pricing

Figure / Business Acquisition

Up to 3 hours of consultation & review

25-30 hours of research & analysis

15-20 hours of material prep & delivery